What’s Cooking with ComplySight!

It has been a few months since the last ComplySight newsletter, and we’ve spent that time working on some additional technical enhancements and updating the content as the result of some recent regulatory updates and changes. These enhancements and updates are discussed in the articles below.

2019 seems like it has flown by in a flash! This will be the last newsletter for 2019, so as we finish out the last few weeks of the year, the ComplySight Team would like to extend our thoughts of gratitude and appreciation to you and wish you a warm and happy Holiday Season! We look forward to an eventful and successful year in 2020!

Recent Regulatory Alerts and Content Updates

The Difference Between a Regulatory Alert and Update Notification

If you are a user with L1 access you may have noticed several emails a couple of weeks ago regarding the ComplySight content. There was a Regulatory Alert email that was a result of changes made by the NCUA to Appraisal Requirements (Part 722), and another email that mentioned Content updates to Directors Responsibilities regarding Fidelity Bonds, which was a result of NCUA amending Fidelity Bond Coverage requirements (Part 713). You may be wondering what the difference is between the two notifications and what you need to do with them.

A Regulatory Alert is communication of a regulatory change that creates new content (an Area, Item, or Factor) in ComplySight. When you receive a Regulatory Alert notification, we recommend you login to ComplySight (as an L1 user) and review the new content. You will have the option to Accept (include this to your list of factors for grading), Decline (do not include this in list of factors for grading) or Delay (make the decision later). If you include the content, you’ll want to review the new requirements to ensure compliance. This could potentially mean an update to policies and/or procedures, additional training for staff, and/or the assignment of a new review for this Area/Item.

A Content Update is a notification that we have updated the wording to an existing Area, Item or Factor. If you have already included the Area, Item or Factor in your ComplySight implementation, the new content will automatically be added. Again, we recommend taking a look at this content to make sure you are in compliance with the changes, and make any necessary adjustments to policies, procedures, training or compliance reviews as needed.

Enhancements Overview

Ability to Reopen a “Resolved” AAI/MAI/EAF

We are happy to announce that we were able to complete a request that we received from several different clients. Users (with proper access) can now reopen an AAI/MAI or EAF that was previously resolved!

- L2 Users can now reopen an Action Item (Manual or Automatic), or an Examiner Audit Finding.

- L3 Users can now reopen an Examiner Audit Finding.

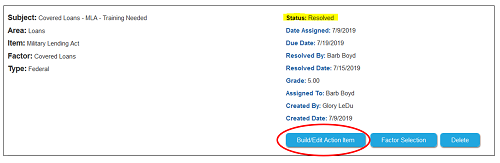

To reopen a resolved item, click on the “Build/Edit” button of the resolved item.

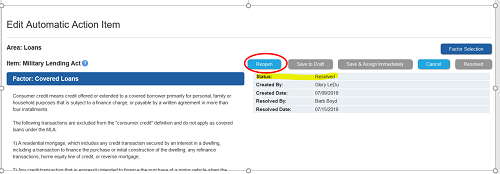

If the user has access to reopen an item, a “Reopen” button will be available near the top right of the screen. Simply click this to reopen the item. You will be asked to confirm this action.

- When an item is reopened

- The status will automatically revert to “Draft”

- The Resolved Date/Resolved By fields will be set to blank

- A notification email will send to the assignor/assignees of the item (those from the time the item was resolved) and to the person who reopened the item

- Once reopened, the item will function like any other item, and will be indistinguishable from any other item.

- Because the item will be set to Draft, it will need to be reassigned in order to change to a status of “In Process.” The Due Date field may need to be adjusted in order to send the assignment. Any other field in the item can be updated, including who the item is assigned to.

Tip: The system does not flag or in any way indicate that an item has been reopened. If it is important to your organization to keep a record of this activity, we recommend adding a comment within the item (example: This item was previously set to Resolved on XX/XX/XXXX by [User]. This item was Reopened on XX/XX/XXXX by [User])

Member/Non-Member Number added to Complaint Form

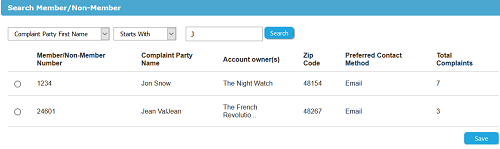

We received a request to add the Member/Non-Member number on the dropdown of the Complaint Form. As the Complaint System usage is growing, some clients provided feedback that they have members with similar (or the same) names and it was difficult to know which one to select from the dropdown. Providing the Member/Non-Member number should alleviate this issue and ensure that the correct member is selected.

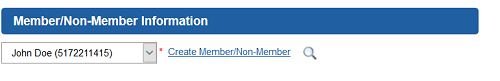

Once selected, the number will remain visible next to the selected member.

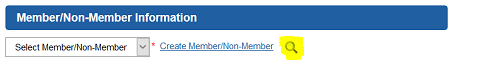

When choosing the Member/Non-Member you can also search if your dropdown list is quite long, and the search results will also show the Member/Non-Member number.

Training & Support

Training

- VIDEO TUTORIALS – Log in to ComplySight and click on the “Training and Support” page to access our video training tutorials library. Our videos will walk you through all of the areas of the Compliance System in ComplySight from set up through Compliance Review Assignments and Grading, to assigning tasks, understanding Regulatory Alerts and the Export Process. For those working on the Complaint side of the system, there is also a complete set of tutorials for the entire Complaint System process!

Support

- Technical questions (software operation issues) or general questions can be submitted through the Technical Support form in ComplySight or sent to support@complysight.com

- Compliance-related questions can be submitted through the Compliance Questions form in ComplySight.

Other Resources

Closing Comments

It is that time of year when we reflect on what we are thankful for, as well as what we have to look forward to. Looking back, I am thankful to all our league/association partners that brought together the two leading compliance management tools for credit unions, ComplySight and AffirmX. I am grateful to every one of you, our credit union users, who continue to allow us to be part of your compliance management operations.

As we head into 2020, I am especially excited to see where your feedback takes us. With NCUA Board Member Harper calling for comments “on his proposal to create a dedicated consumer compliance exam program for large, complex credit unions,” I can imagine we have our work cut out for us.

Happy Holidays and Happy New Year!

Melia D. Heimbuck

CU Solutions Group, Principal of Risk Management Solutions

|